USPTO Releases Report on Distortions Caused by Chinese Monetary Incentives for U.S. Filings

On January 13, 2021, the United States Patent & Trademark Office (USPTO) released a report entitled Trademarks and patents in China: The impact of non-market factors on filing trends and IP systems. The report covers patent and trademark filing trends in China and the United States and the non-markets factors (i.e., money) behind the filing trends. For example, China has reportedly adopted more than 70 subnational trademark subsidy measures, including measures for domestic and foreign applications and

registrations. Further, all 31 Chinese provinces/municipalities have patent subsidy measures.

Trademarks

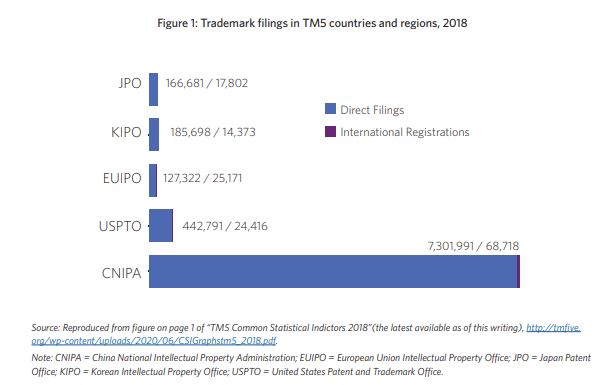

As can be seen in Figure 1 Chinese trademark filings are significantly higher than other countries. The USPTO explains that subsidies may play a major role “because the amount of these subsidies often exceeds the cost of registering a trademark, a rational economic actor in China may choose to pursue a trademark application without any intention to use the mark in commerce.” This was evidenced “the USPTO experienc[ing] a

surge in fraudulent trademark applications originating

in China” after Shenzhen and other cities started offering subsidies for foreign trademarks.

The particulars of the Shenzhen situation are instructive. In 2013, Shenzhen issued operating procedures that allowed applicants to seek a subsidy of RMB 5,000 (approximately $750) for trademark registrations in eligible foreign countries, including the United States.12 After the USPTO lowered the fee for its lowest-cost, fully electronic applications to $225 in

2015, the cost to file at the USPTO was substantially lower than the amount of the subsidy.13 In four years (fiscal years 2013–2017), U.S. trademark filings from China increased by 1,264 percent, with applications from Shenzhen accounting for more than 42 percent of applications from China in fiscal year 2017.

Other factors driving trademark filings include a government mandate to state-owned enterprises (SOEs) to increase by 50 percent their trademark filings under the Madrid System for the International Registration of Marks and third parties trying to profit from bad-faith trademark filings by “ransoming” legitimate trademark owners’ trademark rights or other means. Ironically, this causes a fourth reason: legitimate brand owners filing defensive trademark applications to preempt bad-faith filers.

Note that bad-faith trademark filings in China may start dropping due to the most recent amendments to the trademark law that explicitly prohibit bad-faith trademarks and imposes penalties on both trademark applicants and the trademark agencies that file bad-faith trademarks. Further, the China National Intellectual Property Administration (CNIPA) issued Administrative Measures for Trademark Agencies (Draft for Comment) (商标代理管理办法 (征求意见稿)) that specifies punishments for trademark agencies that file bad-faith trademark applications on behalf of their clients.

Patents

Chinese-originated patents have additional non-market incentives according to the report, especially monetary incentives. The USPTO report stated there are 195 reported patent subsidy measures in China. In addition, there are government targets – “on March 11, 2020, China directed

its 128 centrally owned enterprises to double their holdings of U.S. and other foreign patents by 2025.”

Subsidies are likely a major factor in the growth of Patent Cooperation Treaty (PCT) applications, in which China was the top filer in 2019. For example, the city of Shanghai provides a patent subsidy of 50,000 RMB (~$7,700 USD) for each foreign patent granted via the PCT versus 40,000 RMB for each foreign patent grant that was filed directly (e.g., via Paris Convention). However, the subsidy for the grant of Chinese patents is only 2,500 RMB.

Not mentioned in the report is that many city districts offer additional or alternative monetary incentives to city-level subsidies. For example, the Pudong district used to offer 100,000 RMB per foreign patent, which could be combined with Zhangjiang Hi-Tech Park’s 100,000 RMB subsidy for foreign patent for a total of 200,000 RMB (almost $31,000 USD in total). (Zhangjiang Hi-Tech Park is a technology park located in Pudong, Shanghai). Both policies appear to have been removed from the official websites.

Likely, these high subsidies encourage the filing of patents to profit off the subsidies instead of protecting innovation.

Other Chinese patent incentives not listed in the report include lower Chinese corporate income tax rates via the High New Tech Enterprise program, listing (IPO) requirement for the Shanghai Stock Exchange’s Science & Technology Board, and reportedly reduced prison sentences.

The full report is available here: USPTO-TrademarkPatentsInChina.

Back to All Resources